utah fast food tax rate

Two years ago as a private citizen Rosemary Lesser was part of a grassroots crusade that stopped the state legislature from raising the sales tax on food. The restaurant tax applies to all food sales both prepared food and grocery food.

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Theres a 485 tax on prepared foods like what you get in a restaurant.

. The Utah sales tax rate is currently. The Coalville sales tax rate is. Overview of Utah Taxes Utah has a statewide flat income tax rate of 495.

Our calculator has been specially developed in order to provide the users of the calculator with not only how. Depending on local jurisdictions the total tax rate can be as high as 87. Layton UT Sales Tax Rate.

In the state of Utah the foods are subject to local taxes. Exact tax amount may vary for different items. The Utah UT state sales tax rate is 47.

Restaurants must also collect a 1 percent restaurant tax on all food and beverage sales. Levan UT Sales Tax Rate. Liberty UT Sales Tax Rate.

Lapoint UT Sales Tax Rate. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. The state of Utah currently taxes food at a rate of 175.

January 1 2022 current. Tuesday marked the 15th day of the Utah Legislatures 45-day session. These transactions are also subject to local option and county option sales tax and that results in a total combined rate on grocery food of 3 throughout the state of Utah.

The reader can likely think of a number of ways they would be able to use the money if they were allowed to keep it for themselves. The County sales tax rate is. This is the total of state county and city sales tax rates.

See Utah Code 59-12. Laketown UT Sales Tax Rate. The minimum combined 2022 sales tax rate for Coalville Utah is.

January 1 2008 December 31 2017. Lesser is trying to end sales tax on food. Kristin Murphy Deseret News.

Back to Utah Sales Tax Handbook Top. Judy Weeks Rohner R-West Valley City talks about HB165 and HB203 which both aim to eliminate the states sales tax on food during a press conference outside of the Capitol in Salt Lake City on Tuesday Feb. How much is fast food tax in Utah.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. This is 7 lower -1747 than the average fast food worker salary in the United States. Time is running out for those bills.

Both food and food ingredients will be taxed at a reduced rate of 175. Did South Dakota v. Rosemary Lesser D-Ogden poses for a photo outside of the Capitol in Salt Lake City on Thursday Jan.

Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor. Wayfair Inc affect Utah. Leeds UT Sales Tax Rate.

You are able to use our Utah State Tax Calculator to calculate your total tax costs in the tax year 202223. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465.

In addition they earn an average bonus of 1057. Report and pay this tax using form TC-62F Restaurant Tax Return. Although restaurants are not required to pay sales tax on food that they purchase for resale they are required to collect sales tax on food that they sell to their own customers.

January 1 2018 December 31 2021. Leamington UT Sales Tax Rate. Do restaurants pay tax on food.

Or to break it down further grocery items are taxable in Utah but taxed at a reduced state sales tax rate of 175. The average fast food worker gross salary in Utah United States is 22163 or an equivalent hourly rate of 11. The example above illustrates what kind of an impact allowing a family to spend the money differently would make.

Lake Shore UT Sales Tax Rate. Lewiston UT Sales Tax Rate. Does Utah have income tax.

Theres a 175 tax on unprepared foods like what you would buy in the grocery store. Lehi UT Sales Tax Rate.

Utah Sales Tax Small Business Guide Truic

Utah Sales Tax Rates By City County 2022

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Business Guide To Sales Tax In Utah

The Most Popular Beer Brands In America Map

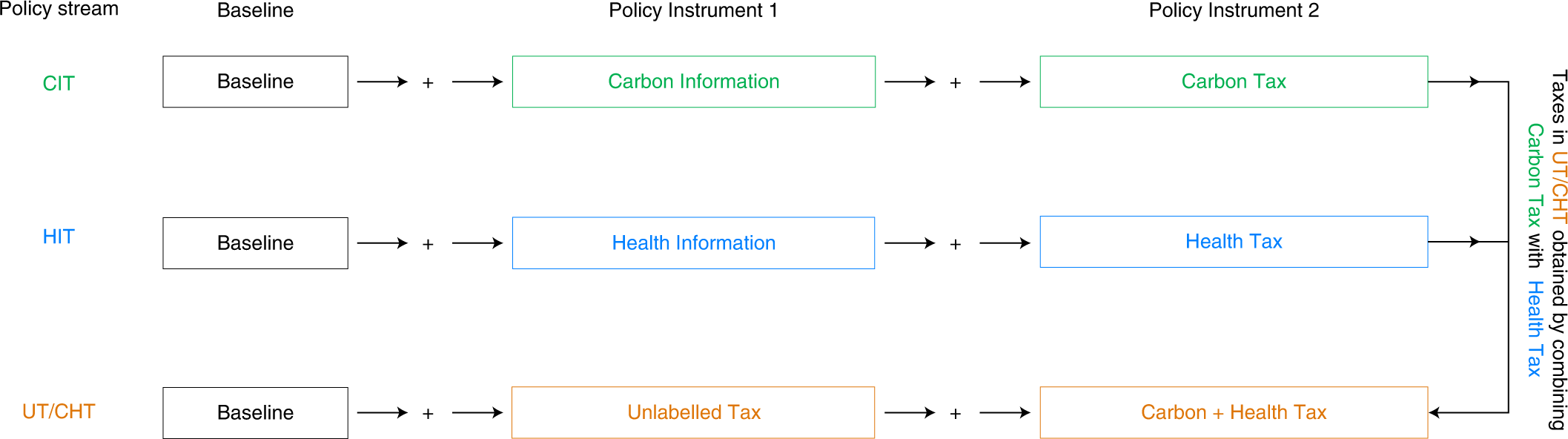

Combined Carbon And Health Taxes Outperform Single Purpose Information Or Fiscal Measures In Designing Sustainable Food Policies Nature Food

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

What Is The Restaurant Tax In Utah Santorinichicago Com

Is Food Taxable In Utah Taxjar

Double Trouble Excel Invoice Template Invoice Template Create Invoice Resume Design

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv